Del's Nightly-ish Watchlist 🌙 3-29-21

Overall for my aggressive swing style, these markets are still too weak and range bound to expect much follow through to the long-side.

If you’re new, subscribe for free! 👇 And read the intro post here. - Del

Hey, I realize everyone may not need a watchlist sent to them every night, so I’m considering putting these nightly-ish watchlist posts inside a thread instead. Please let me know in this poll.

📊 Poll: Do you want to continue to receive these nightly-ish watchlists in your email?

SPY threatening to top, but really just sideways.

We’re in a tight consolidation on SPY after printing 403 Sunday night. IMO, this could easily be a topping pattern on any other chart, but because this market is being zombied(my term for FED driven, dealer hedged, melt-up), I think we’re likely to see markets push up deep before another rubber band incident.

Overall for my aggressive swing style, these markets are still too weak and range bound to expect much follow through to the long-side.

I’m doing my best to pick out names with daily high IV fall-off, as they seem to be the only ones generating range.

Markets are highly sensitive to the VIX right now.

As I’ve said before, when the market behaves this way, there is no clearer indicator than the VIX. I watch this like a hawk during the day, looking for breakouts.

My rules of thumb:

Breaking up to $31, I’m short bias.

Fall from $31, I’m long bias on breakdowns.

Trading above $31, options volatility heaven.

Tonight’s Watchlist

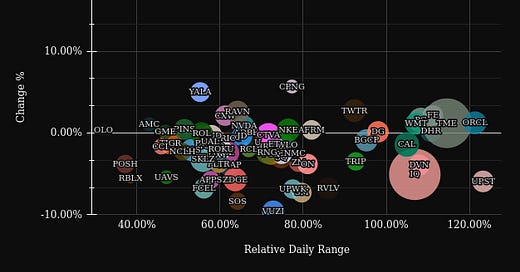

As you can see below, today’s distribution of range and implied volatility was all over the place. There were some clear winners but I don’t think the markets were sure if we were going up or down. Take a look at the last watchlist, you’ll see the difference. This is consolidation. Time to take profits and play some video games.

Here’s what I’m looking to refine down in the morning.

Good luck out there!

— Del (twitter)