Del's Nightly-ish Watchlist 🌙 3-31-21

🐖 And in the pig scenario, we gap up into or over 400 on SPY, and QQQ doesn’t look back. FOMO central.

If you’re new, subscribe for free! 👇 And read the intro post here. - Del

Breakout Attempt on SPY, Success on QQQ

SPY — really went for it today around mid-day, attempting to break out of the range. We had tech leading the charge and a lot of traders seemed trigger happy. I joined the party a bit and opened some positions, but we’re still not out of a larger consolidation and breakdown between 390 and 400.

It’s going to be quite the battle, and probably a spectacle when price does close above 400 for the first time.

QQQ — It was clear this morning that with the breakout of the wedge(from yesterday’s post), we were likely to have a run for the larger trendline. We knew what to look for.

VIX — Extending its depression, drooping under 20 into the close.

🐂 Tomorrow in the bull scenario, I’m looking for SPY to show strength above 397, and QQQ to re-test the trendline, base, then take off. VIX will need to make new lows I believe for this to get any traction.

🐻 Alternatively, in a bear scenario, we’d see SPY trash the channel lows, and make a run for 390. QQQ would likely fail under the larger trendline, and would spike above 21.

🐖 And in the pig scenario, we gap up into or over 400 on SPY, and QQQ doesn’t look back. FOMO central.

Watchlist

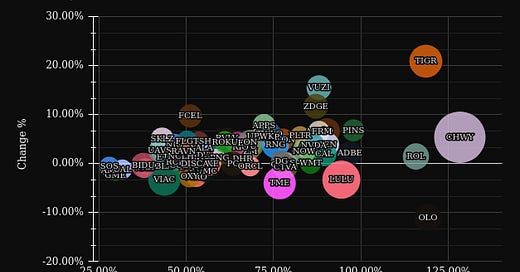

Tickers were performing well, most had nice pops due to the larger market moves, but IV was relatively low in the names I was watching. Likely rotation into big tech names today.

Setups

There were quite a long few setups due to the bullishness. I opened long positions on TWTR, ROL, and TME today.

Some of the names with TA setups I’m watching closely. When swing trading I prefer to pick not only names with TA setups but also with fundamental strength or stocks that have momentum or sector stories.

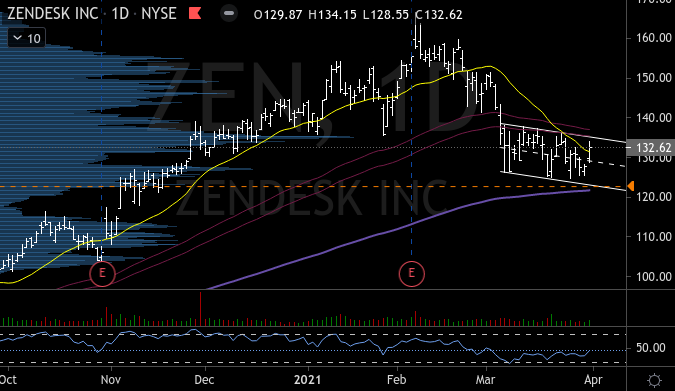

ZEN — Zenhub with a nice channel seen out to the daily chart.

ROKU — Looking for a re-test of 320, or 321 before continuing higher.

TRIP — That right shoulder holding up despite the underlying market strength. Another checkbox ticked for a possible short.

UPST — UpStart, a strong momentum name with a flag that looks like it just got broken EOD/Afterhours. We’ll see if we rally back into it tomorrow.

TSLA — Don’t really care what’s going on in the backstory, all I know is that Tesla is the king of wedges. I’m long if it continues consolidating in a tighter sideways range.

Have a great trading day, and please share the love if you can.

— Del (twitter)