Del's Weekend Review & Watchlist 🌙 3-28-21

What a week for the markets with SPY continuing to gain strength against the relatively weaker tech sector. QQQ still fumbling for its breakout. In the last Nightly-ish watchlist we talked about...

👋 Hey everyone, hope you’re enjoying the content so far. If you have any suggestions or feedback, feel free to drop a comment below. And if you’re new subscribe for free and read the intro post, here. - Del

Content inside:

Market overview

Open/closed swing positions

Nightly watchlist

Nightmare block selling

Market Overview

What a week for the markets with SPY continuing to gain strength against the relatively weaker tech sector. QQQ still fumbling for its breakout. In the last Nightly-ish watchlist we talked about the 390 level being a key breakout, SPY has conquered that level and may go full zombie mode this week beyond 400 if it can stay above 390.

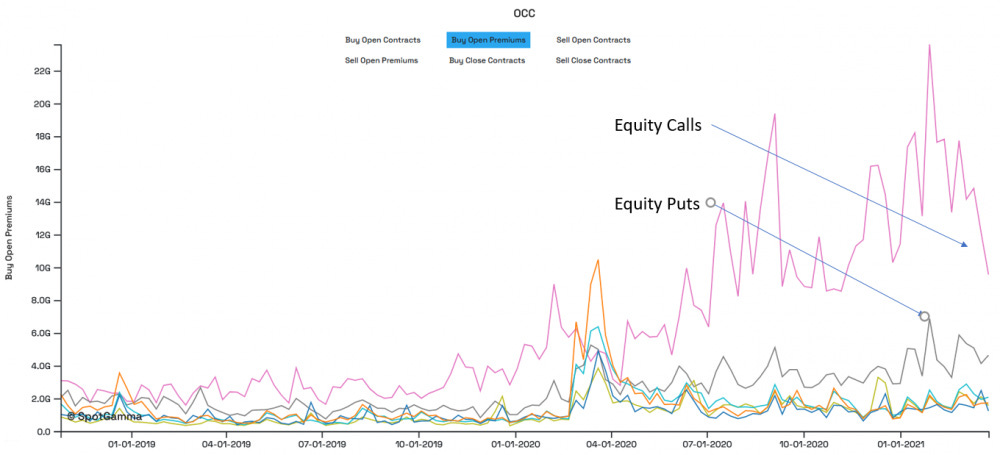

We just had a Sunday print of 403.9 on the SPY. Given that call buying is continuing to contract from its highs, we may continue to see that rotation in IV from the meme stock names, distributed back into the zombie Powell driven “recovery rally”.

On the other hand… The markets from a technical perspective, feel weak, heavy and jittery. We may continue to flirt with over-extended washouts due to dealer gamma hedging, and BTFDs leading to zombie rallies.

Open/Closed Swing Positions

Open — WMT JD DG

Closed — DHR(win), IQ(loss), OLO(win), MNST(win), ETSY(win), ET(loss), FLGT(win), UAL(win)

I currently have 3 open positions, WMT JD DG, which are performing well despite the market turbulence. In the current market, following leaders in daily option volume is key.

I have scaled down the number of positions into the weekend because I’m not very trusting of the current market environment. A lot of failed longs and bearish setups across the board. I do have one short off the book, GME puts out to mid-April.

To put it into perspective last week I had as many as 15 open positions at once.

Nightly Watchlist

Implied volatility continues to play a big role in the momentum of names across the board. This relationship has expanded from being centralized on meme names back in the WallStreetBets months, to rotating out into larger cap and popular themed tickers as the overall market call option buying slowly decreases.

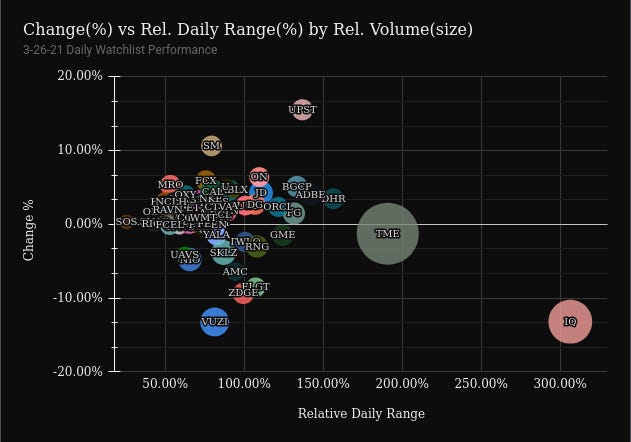

Here’s my watchlist. Again, to be refined tomorrow morning.

Nightmare Block Selling

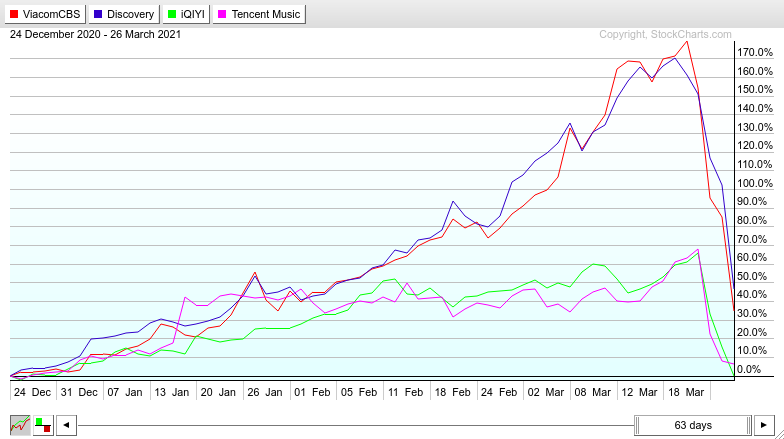

The big story of the week was VIAC, DISCA, IQ, TME + Chinese-related tech names, completely chopped down. Losing more than half of their value in 2-3 trading sessions. I was actually long IQ for a swing trade.

I just let my stop hit, but realized afterwards that something larger was going down.

Archegos Capital was the firm that had dropped massive multi-billion-dollar block sales on many of these names.

“Archegos Capital, a private investment firm, was behind billions of dollars worth of share sales that captivated Wall Street on Friday — a fire sale that has left traders scrambling to calculate how much more it has to offload, according to people with knowledge of the matter. The fund, which had large exposures to Viacom CBS and several Chinese technology stocks, was hit hard after shares of the US media group began to tumble on Tuesday and Wednesday.” - FT, Bloomberg

Traders will be cautious around many names related to Archegos Capital holdings this week. No doubt may also be an opportunity for many traders to buy the dip.

And just as I’m writing this article, blood still in the water:

More explained here in ZH’s article. And here is CNBC.

That’s it! see you tomorrow. Have a good Monday open.

In case you missed it, I posted a new issue earlier today on analyzing your trading data. You can find that here.

— Del (twitter)