If you’re new, subscribe for free! 👇 And listen to the intro post here. - Del

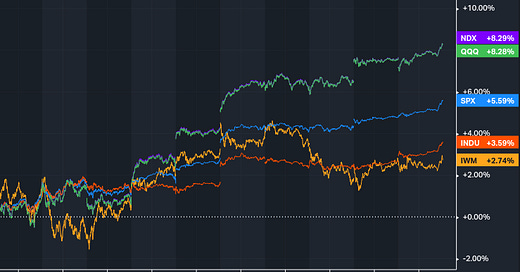

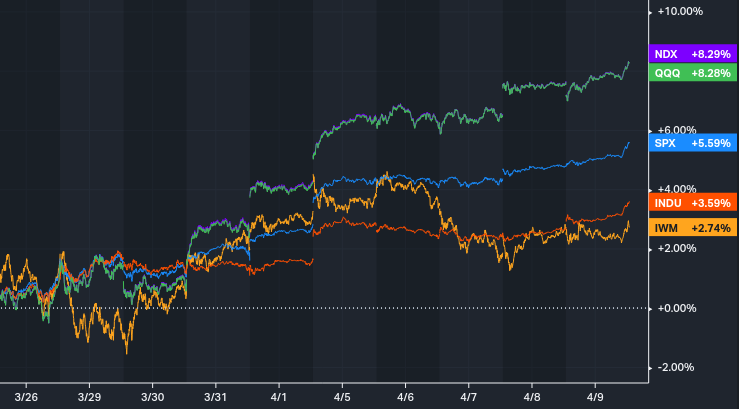

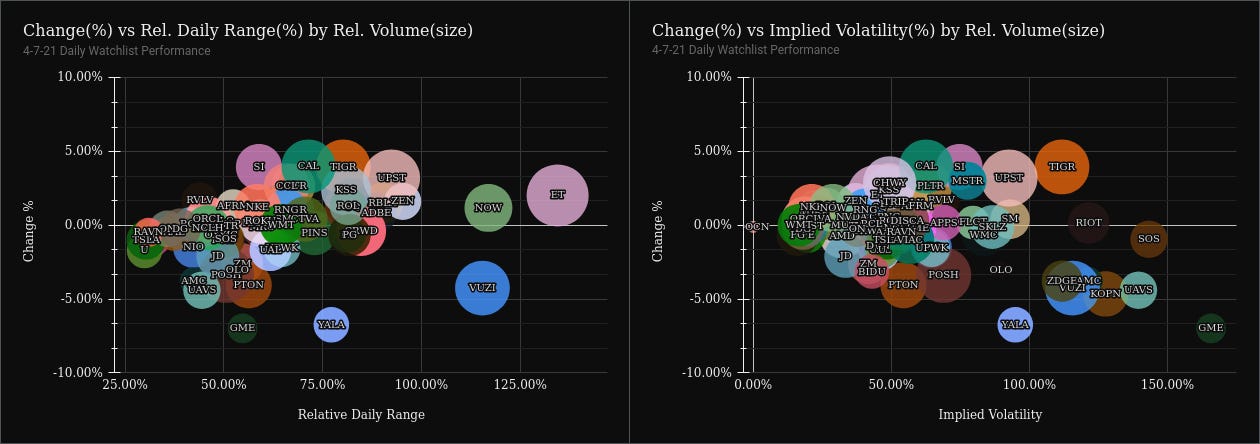

This week was the market grinding higher, painfully, on low relative volatility. Very low volatility.

Could be the summer months, could be the shock of a new ATH on the SPY. Who knows, who cares. As a swing trader, I’m taking profits early on my A- setups, and looking to add to my A+ setups until the market tells me otherwise.

Crypto Note Special

This Wednesday, Coinbase, the largest US crypto exchange has its IPO under ticker COIN. I’ll be watching Coinbase closely like everyone else, and given the market dynamics and its insane fundamentals, this stock could get a lot of attention.

Range and volume overall were pretty slow for most of the week as VIX remains suppressed and the overheated call volume on the SPX takes a breather.

Of all of the crypto-related names, GLXY is my favorite. They have a strong team and are making the right moves in the crypto space from here in Canada. This is a long-term hold for me as well as a short-term trade since the range is spectacular on the stock right now.

RIOT, MARA, MSTR I think won’t benefit as much from the exploding crypto market as GLXY will.

I don’t normally cover crypto in this newsletter, but it’s worth reviewing as it will likely be the main theme driver going into this week. Unless you’ve been living under a rock, Bitcoin and Ethereum are at all-time highs, AGAIN. They seem to be acting as the opposing balance to the FED’s current monetary policies and globally are positioned to be taken advantage of by the biggest companies and countries in the world.

Their dominance will be fought over for decades.

It’s really as simple as that for me. This is why I’ve been an investor in the crypto space since 2013 and have also contributed professionally to the development of Ethereum and the crypto gaming space.

Bitcoin to break out.

Despite Ethereum being the workhorse behind the growth of crypto innovation and larger percentage gains than Bitcoin, the markets are currently responding to movements in Bitcoin price. A relationship that we’ll see level out as more companies convert their piggy banks into BTC.

The Coinbase IPO could push the crypto space to another dimension, as it widens the effect on crypto-related names and their blast radius. However… it’s entirely possible that this dynamic creates a short-term blowout top for the stock/crypto relationship which could spiral into something else for the crypto market. Either way, I'll be watching ETH, BTC, COIN, and GLXY for a themed week given the low volatility and starved active traders.

Watchlist

Going into Monday, keep the current themes in the back of your head. Put setups and higher timeframe analysis front and center. Focus on defining your risk and executing to plan. No need to continue contemplating what will happen while it’s happening.

Swing Positions

Long

TIGRfrom 18.10 avgZENfrom 142.13 avgAPPSfrom 87.88 avgKOPNfrom 11.09 avg

Short

TRIPfrom 54.68 avg

Have a great Sunday night.

— Del (twitter)