Del's Nightly-ish Watchlist 🌙 3-30-21

Technical setups now too, not just a list of tickers. Sideways Shuffle in Markets, Watchlist Review, Select TA Setups.

If you’re new, subscribe for free! 👇 And read the intro post here. - Del

🙏🏻 Thanks for the reply to yesterday’s poll on the value of this Watchlist so far. Overwhelming support. 88.9% of you said you want to keep receiving the watchlist, 11.1% said you’re not sure yet.

I’ll work on making it more valuable. I’ll be adding technical setups of the tickers instead of just posting a list of tickers.

Inside:

Sideways Shuffle in Markets

Watchlist Review

Select TA Setups

~~~

Sideways Shuffle in Markets

We had a range bound day today in markets as we expected from last night’s review.

SPY — We have key levels of support underneath, the strongest being at 390. There’s also a larger ascending trendline that could be strengthened if there is a dip below 390.

Until price can break out of the 396.5/393.5 range it’s in, I would expect continued sideways action and not much follow-through on longs.

VIX — Adding to the sideways stewing is the VIX inside of a tight 2 1/2 point range as well, but near all-time lows. I’m patiently waiting for a resolution breakout on either name.

QQQ — Inside an even tighter consolidation. Not even attempting to test the larger trendline above.

Watchlist Review

No clear winning themes today, just a bunch of kids chasing the soccer ball around the field.

I won’t post an updated watchlist today due to a lack of change, here is the list from yesterday.

Select TA Setups

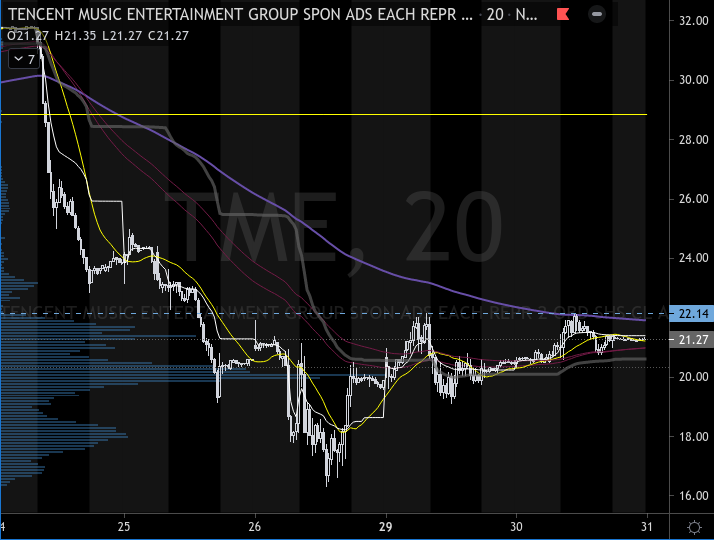

BIDU, TME, VIAC, DISCA

BIDU — Opened a long today after the breakout and pullback of an inverted head and shoulders.

TME — A similar setup can be seen TME as well. I just like BIDU’s breakout a bit better.

Of these crushed China names from yesterday, VIAC and DISCA have the flattest price action so far. I’ll be watching all of these form bases against the 200 EMA throughout the week on the 20-minute chart, as they have the potential to gap into large relative range moves.

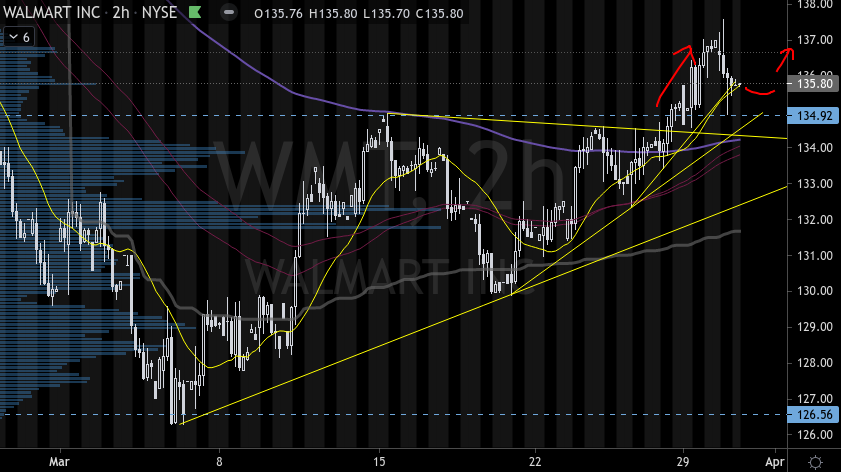

WMT, DG

WMT — I have an active position which I took profits on yesterday. Looking for a base above 135 for an opportunity to add into broader market strength.

DG — A very strong trend on Dollar General, especially on the daily. What a great recovery from the mid-march dip.

I closed out a long into the 205s level due to this very strong area of conflict. I did manage to buy calls out until May, however.

The trade on such strength was hard to pass up.

TRIP — Nice head and shoulders setup on Trip Advisor. Further virus fears or flight restrictions could tank it from here. I’ll be ready.

That’s it! 👋 Have a good trading day.

P.S. I’m working on a bunch of new “Issues” which will have their own podcasts attached to them. A really cool feature of substack.

This will differ from the “Episodes” of BVP that will be interviews with industry people.

So… Issues = Deep dives with audio podcasts. Episodes = Numbered interviews with guests. Let me know what you think in the comments!

— Del (twitter)

Issues = Deep dives with audio podcasts. Episodes = Numbered interview podcasts.