Del's Weekend Watchlist 🌙 4-4-21

Overall, I’m long, looking to load up on my technical long setups if we get seller weakness. VIX needs to stay sub 20, and SPY needs to hold above 400 for A+ long setups.

If you’re new, subscribe for free! 👇 And read the intro post here. - Del

Well, it looks like we went full piggy scenario across markets with energy and technology leading the charge. As we talked about last time, the SPY range between 393-397 is what I had my eye on as the VIX continued to show weakness.

VIX is now bleeding lower. The true test will come hopefully this week when we get a “healthy” — if there is such a word in this market — pullback that solidifies the push higher into a new range discovery above SPY 400 / SPX 4000.

Overall, I’m long, looking to load up on my technical long setups if we get seller weakness. VIX needs to stay sub 20, and SPY needs to hold above 400 for A+ long setups.

Call option activity continues to decline rapidly. Again, a sign that the markets are ready to zombie higher. RIP meme stocks.

Watchlist

Volume pumped into the markets as everyone jumped headfirst into the potential 4k break on the S&P. Buyers initiating is what we saw into lunchtime. As you can see below, a healthy distribution of both dollar volume and options volume. This is what I love to see before a new wave of accumulation hits the markets.

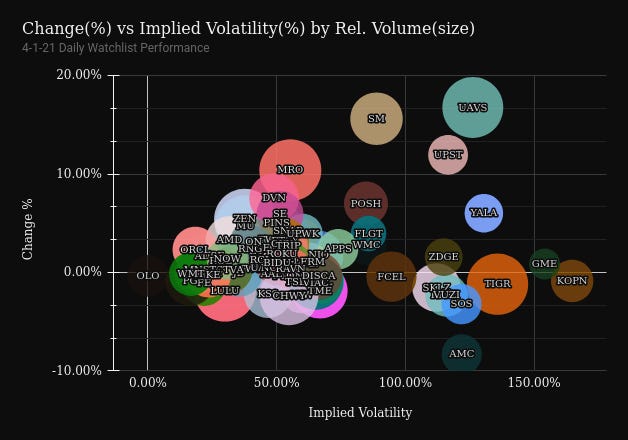

As for the watchlist. I’ve automated this list on my end, it now pulls the leaderboard of stocks that meet my own requirements from an options, technical and fundamental perspective.

The top 3 is what I go into the next trading day keeping a close eye on. I then refine the list based on morning activity and performance at the open.

Setups

UPST — I opened a long position on Upstart at the beginning of the trading day. It performed perfectly. I’m looking to size in further as I watch the volume closely for a bull wedge breakout.

KOPN — Beautiful bull flag coming together on the 4h+ charts. Not on too many people’s radar since it’s been going sideways for a while, but I do like the opportunity to get in before the momentum crowd.

TRIP — Trip Advisor is really making it hard to not short right at this point as it holds the textbook right shoulder of this H/S pattern. Of course, shorting anything as markets enter into bull expansion is not advised.

TSLA — As I mentioned in the last post, Tesla is fertile ground for wedge breakouts on the daily. In the last session, Tesla confirmed my suspicions as it just put in its third/fourth failed attempt to break out of this larger wedge formation. I’m now looking to accumulate long TSLA under 640, risking the previous lower low. Let’s hope it gets down there.

ZEN — I just want to point out how Zendesk is breaking my heart right now. I pointed out this bear channel that was ready to break out in the last post. It gapped up the next morning without me and hasn’t looked back. SOB.

One more thing. Crypto has been on an absolute tear. I’m looking at RIOT, MSTR, MARA for secondary plays against bullish breakouts on BTC. These trades are off the books of course, so I’ll be treading lightly.

Have a great trading day, and happy easter!

— Del (twitter)